Most modern economies today aren’t completely free-market or entirely government-run. Instead, countries mix both systems to balance progress with public welfare. The result? Economic policies that influence how people manage their income, credit, and savings and, in turn, their overall financial health. In this article, we’ll explore what defines such a system, its key features, and why it plays a vital role in today’s world.

What Is a Mixed Economy?

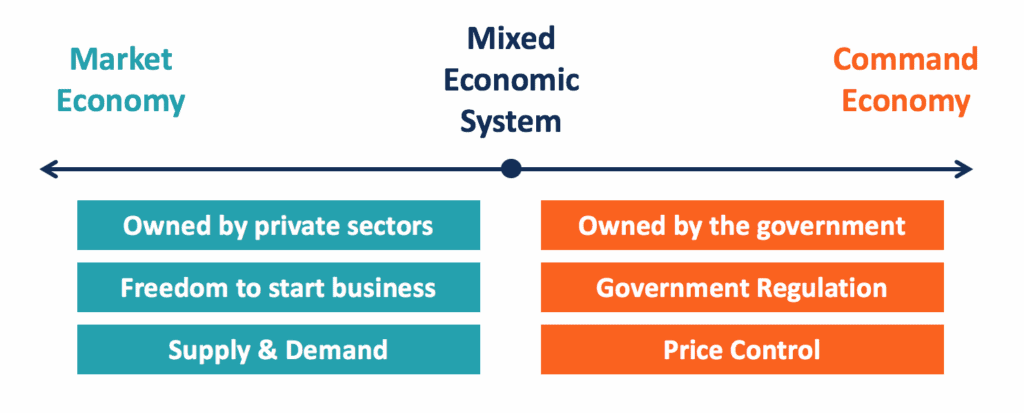

A mixed economy is an economic system that blends elements of both capitalism and socialism. It allows private sector individuals and businesses to own property, run enterprises, and pursue profits, while the government plays an active role in regulating markets and ensuring social welfare. This balance combines capitalism with the equity, stability, and protection mechanisms of socialism.

Some countries adopt a mixed economy because it minimises the risks of a state having polarising governance. It curbs unchecked inequalities of a purely capitalist system and the inefficiencies of a purely socialist one. When the merits of both are combined, nations can encourage economic growth while safeguarding citizens’ needs.

Today, most modern economies operate within this mixed model. Prominent examples include the United States, the United Kingdom, Germany, China, Japan, India, and Canada.

Data reference: Source

Mixed Economic System Explained

In a mixed economic system, government intervention and private enterprise operate side by side to create balance. While private businesses bring in innovation, competition, and consumer choice, the government steps in to regulate industries, provide public goods, and ensure fair practices.

For example, companies may freely produce and sell goods, but the state enforces labour laws, sets safety standards, and manages essential sectors like healthcare or defence. This coexistence allows markets to function efficiently while protecting citizens from exploitation or inequality. The result is an economy that benefits from both entrepreneurial freedom and social responsibility.

Key Features of a Mixed Economy

A mixed economy combines elements of both capitalism and socialism, creating a balanced economic system. Its primary characteristics include:

Dual Ownership Structure

Both private individuals and the government own resources and enterprises. Private businesses operate alongside state-owned entities in sectors like healthcare, education, and infrastructure.

Market-Driven Mechanisms

Prices, production, and distribution are largely determined by supply and demand, allowing consumer choice and competition to drive efficiency.

Government Regulation

The state intervenes through policies, regulations, and laws to prevent market failures, protect consumers, ensure fair competition, and maintain economic stability.

Social Welfare

Governments provide public goods and services- education, healthcare, social security, addressing inequalities that pure market systems might ignore.

Economic Planning

Strategic sectors such as defence, energy, transportation, natural resources, and healthcare receive government oversight while maintaining private sector freedom, balancing growth with equity.

This system lets the free market and the government work together. It uses the strengths of both sides while trying to reduce their drawbacks.

Examples of Mixed Economies Around the World

Most modern economies operate as mixed systems, though they vary in their balance between market freedom and government control.

India

India adopted a mixed economy post-independence, blending socialist planning with market principles. The government maintains control over strategic sectors like defence, railways, nuclear energy, and major banks through public sector undertakings (PSUs).

After the 1991 liberalisation reforms, private enterprise expanded widely in manufacturing, IT, telecommunications, and retail. The state continues intervening through regulations, subsidies for agriculture and essential goods, price controls, and welfare schemes like food security and employment guarantees, while encouraging foreign investment and entrepreneurship to drive growth.

United States

The United States runs mostly as a market-driven economy, where private ownership is widespread and businesses compete freely. Prices are largely shaped by supply and demand, with limited government interference in everyday trade. Still, the government steps in where necessary, regulating industries like banking, healthcare, and environmental protection.

The U.S. government also provides safety nets such as Social Security, Medicare, and unemployment benefits. During economic slowdowns, the state supports recovery through stimulus measures (increasing spending on public infrastructure) and monetary policies (lowering interest rates). The Federal Reserve works to keep the financial system stable, while antitrust laws prevent monopolies, creating a balance between open markets and smart regulation.

Other examples

United Kingdom

Strong private sector with the National Health Service (NHS) providing universal healthcare. The government regulates utilities, financial services, and maintains welfare programs while encouraging entrepreneurship.

France

They have a strong state involvement in energy, transportation, and telecommunications alongside vibrant private enterprise. Extensive labour protections, public healthcare, and generous social benefits coexist with competitive markets.

Germany

Known for its social market economy, Germany balances a manufacturing and export-driven private sector with strong worker protections, universal healthcare, and substantial government investment in education and infrastructure.

China

Describes itself as a “socialist market economy” with extensive state ownership in key industries like energy and telecommunications, yet allows considerable private enterprise and foreign investment in manufacturing and technology sectors.

Sweden

Combines capitalism with comprehensive welfare systems, featuring high taxation funding education, healthcare, and social services while maintaining competitive private businesses.

Here, each nation calibrates its mix differently based on historical, cultural, and economic priorities.

Balanced Resource Allocation

In a mixed economy, resources are distributed between public and private sectors based on efficiency and social priorities. This affects how citizens build financial security and credibility, making it essential to understand how to build a strong financial profile. As mentioned earlier, the private sector allocates resources through market forces, ie, supply, demand, and profit motives, ensuring competitive pricing and innovation.

On the other hand, the government directs resources toward sectors requiring universal access or long-term planning, such as public infrastructure, healthcare, education, and defence. This dual allocation prevents resource concentration, ensures essential services reach all citizens regardless of profitability, and allows market mechanisms to drive efficiency where appropriate, optimising overall economic productivity and social welfare.

Consumer Protection and Social Welfare

Government regulations protect consumers from fraudulent practices, unsafe products, and unfair pricing. This is done through quality standards and oversight agencies. Social welfare programs act as safety nets. They include unemployment benefits, pension schemes, healthcare subsidies, and food security measures. These ensure that vulnerable populations maintain basic living standards. Similarly, individuals can safeguard their finances by staying alert to scams and understanding how to spot and prevent digital payment fraud.

Minimum wage laws, worker protections, and labour rights also prevent exploitation. Such interventions cushion individuals during hardships, illness, or unemployment. They promote social stability and reduce poverty, while still allowing market activities to continue. In this way, economic freedom is balanced with human welfare.

Encouragement of Private Enterprise

Entrepreneurship takes off when property rights are safe and contracts are enforced. The state helps with startup incentives, tax breaks, subsidised loans and grants so ideas can grow. Strong IP rules reward inventors and creators, encouraging more research.

Cutting red tape and simplifying rules makes starting a business less painful. When governments invest in schools and roads, businesses find skilled people and better links. All this adds up to a place where people can build businesses, chase profits, and still compete on a level playing field.

Disadvantages of a Mixed Economy

Despite its benefits, a mixed economy faces several significant challenges:

Bureaucratic Inefficiencies

Government-run enterprises often suffer from red tape, slow decision-making, and a lack of accountability compared to private businesses. This can lead to wasteful spending, delayed projects, and poor service delivery.

Regulatory Complexity

Excessive or unclear regulations create confusion for businesses, increasing compliance costs and discouraging investment. Overlapping agencies and complicated procedures can restrict entrepreneurship and innovation.

Corruption and Rent-Seeking

Government control over strategic sectors creates opportunities for bribery, favouritism, and misuse of public resources. Political connections may influence business licenses, contracts, and subsidies unfairly.

Conflicting Objectives

Balancing profit motives with social welfare goals can create policy contradictions. Governments may struggle to determine optimal intervention levels, either over-regulating and hampering growth or failing to serve citizens.

Resource Misallocation

Political considerations rather than economic efficiency may drive government spending, leading to subsidies for unviable industries or neglect of productive sectors.

Fiscal Burden

Extensive welfare programs and public sector operations require high taxation, thus reducing private investment and individual incentives.

Government Intervention Issues

Excessive government regulation can slow economic growth by adding layers of bureaucracy that delay business decisions and raise operating costs. Overregulation also discourages entrepreneurship, since dealing with complex compliance rules is both time-consuming and expensive.

Rigid labour laws may stop companies from adapting quickly to changing market conditions. High taxes, used to fund social programs, can limit private investment and innovation. In some cases, governments protect inefficient public sector enterprises. This drains resources, reduces competition, and weakens productivity. Over time, such practices undermine the economic growth needed for long-term prosperity.

Conflict Between Public and Private Sectors

Tensions can arise when businesses chasing profits clash with government goals for public welfare. Companies may cut costs in ways that affect quality, worker safety, or the environment. At the same time, government priorities like affordability and universal access can conflict with what’s commercially viable.

Private firms sometimes lobby for policies that favour their interests over the public good. Public sector inefficiencies can frustrate private partners in joint ventures. Deciding which sectors should stay public or be privatised also sparks debate, as stakeholders try to balance profitability with fair and responsible service delivery.

Risk of Inequality

Even with welfare programs and regulations, mixed economies can still face significant inequality. Access to opportunities often depends on education, location, and family background. Wealthier individuals usually have better access to capital, networks, and resources for business or investment.

Urban areas often get more infrastructure and job opportunities than rural regions. Markets also tend to reward certain skills and industries more, creating income gaps. While government redistribution through taxes and welfare helps, it can’t fully close these divides. Limited budgets, administrative challenges, and policy gaps mean some communities remain underserved despite well-intentioned programs.

Impact of a Mixed Economy on Citizens

Citizens living in mixed economies enjoy a mix of opportunities and responsibilities.

Employment

Workers benefit from labour protections, minimum wages, and workplace safety standards while accessing diverse job opportunities across public and private sectors. Government employment schemes provide security, though private sector jobs often offer higher salaries and innovation-driven careers.

Taxation

Citizens pay taxes on income, sales, and property, which fund public services. While higher taxation reduces disposable income, it finances healthcare, education, infrastructure, and social security that benefit society collectively.

Social Services

Universal or subsidised healthcare, public education, and welfare programs ensure basic living standards regardless of income level. These safety nets provide security during unemployment, illness, or retirement.

Consumer Experience

Regulations ensure product safety and fair pricing, though bureaucratic processes may cause delays. Citizens enjoy market choices while protected from exploitation.

Conclusion

A mixed economy combines the strengths of both market-driven systems and government operations, while also having some limitations from each approach. It enables innovation and competition alongside public services and social protection.

Citizens benefit from employment opportunities, safety nets, and consumer protections, though they also face taxation and occasional bureaucratic hurdles. In practice, most countries today operate as mixed economies, with each finding its own balance between private enterprise and state intervention based on national priorities and circumstances.

Disclaimer: This blog is intended for educational purposes only.