Employer-provided cars and leased vehicles have become one of the most popular workplace perks among salaried employees and managers in India. They offer everyday convenience, predictable costs, and most importantly significant tax benefits under current income-tax rules.

The momentum isn’t just local, globally, the car leasing market is estimated to be worth USD 118.8 billion in 2025 and projected to reach USD 193.6 billion by 2035, growing at a 5% CAGR. This rising adoption reflects how leasing is increasingly preferred over traditional ownership, especially for tax-efficient planning.

Understanding Employer-Provided Car Lease

In the employer-provided car lease model, the company signs the lease agreement with a leasing provider and takes responsibility for the monthly payments. These EMIs, along with costs like insurance and maintenance, are usually routed through the employer. The employee then contributes a portion of the cost through structured deductions under a flexible benefits plan. Because these payments are made before tax is applied, the employee’s taxable income reduces.

The employer handles the administration, the employee enjoys predictable monthly costs, and the overall structure creates a smoother, more tax-efficient way to use a car compared to buying one personally.

How the Car Lease Model Works

In a typical employer-provided car lease, the company enters into a lease agreement with a car leasing provider and pays the monthly EMIs directly. These costs often include insurance, maintenance, and road tax, all bundled into the lease. The employee then contributes a portion of the total cost through structured deductions under a flexible benefits plan.

Since these deductions happen before tax is calculated, the employee’s taxable income reduces. The employer handles all paperwork and payments, while the employee enjoys a convenient, predictable, and tax-efficient way to use a car without taking a loan personally.

Eligibility for Car Lease Benefit

Car lease benefits are typically offered to middle and senior-level professionals, especially those in roles that involve frequent client meetings and travels. Employees in sales, consulting, operations, and leadership positions are the most common beneficiaries. Since these roles require mobility and representational responsibilities, companies often extend car lease options as part of a flexible benefits or CTC structure.

The perk is designed to balance convenience, efficiency, and tax-friendly compensation for employees who rely heavily on regular travel.

What Are the Tax Benefits of Leasing a Car?

Leasing a car through your employer offers multiple tax advantages because several components of the lease are treated as non-taxable.

(A) Employee Benefits (Paid with Pre-Tax Income)

- Lease rentals

- Insurance

- Maintenance

- Driver salary (if included)

(B) Benefits for Employers

For employers, car leasing is equally attractive, offering key financial and administrative advantages:

- Claim Lease Rentals as Business Expenses: This directly reduces the company’s overall tax liability.

- Avoid Depreciation and Asset-Management Burden: Companies don’t have the administrative hassle associated with purchasing and owning vehicles outright.

- Maintain Flexibility: Because the car is leased, not owned, employers can easily upgrade or return vehicles at the end of the term.

Altogether, this structure creates a mutually beneficial model where employees enjoy substantial tax optimisation while employers reduce costs and administrative complexity under a compliant and efficient compensation benefit.

Tax Savings for Employees

Lease rentals in an employer-provided car lease are taken from pre-tax income, which directly reduces the employee’s taxable salary. Since the lease rental, insurance, and maintenance are routed through the employer, these costs are excluded from the portion of income on which tax is calculated. For example, if an employee earns ₹20,00,000 annually and contributes ₹20,000 per month toward the lease (₹2,40,000 yearly), the taxable income drops to ₹17,60,000. At the 30% slab, this reduction alone saves about ₹72,000 in tax, even before counting additional savings from fuel or driver allowances.

Tax Deductions for Employers

Companies benefit from car lease arrangements because all related payments, such as:

-Lease rentals

-Maintenance charges

-Insurance premiums

-Fuel reimbursements

And this can be claimed as legitimate business expenses under the Income Tax Act. These deductions reduce the organisation’s taxable profits, lowering its overall tax liability. Since the car is leased rather than owned, the company also avoids dealing with depreciation claims and asset management. This turns the lease into a clean, compliant, and financially efficient structure that supports operational needs while keeping the company’s books lighter and more flexible.

No Capital Outflow for Employees

Employees don’t have to deal with heavy down payments or take a personal car loan, which means no traditional EMIs eating into their monthly cash flow. The lease cost is handled by the employer and recovered through structured, pre-tax deductions. This keeps the employee’s liquidity intact, avoids long-term debt, and makes driving a new car far more accessible than purchasing one outright. It’s essentially a way to upgrade mobility without disrupting personal savings or financial stability.

GST and Depreciation Advantages

There’s a quirk in India’s tax rules that’s worth clarifying so the piece stays accurate. For employer-provided car leases, companies cannot claim GST input credit on motor vehicles used for employee transportation, because GST law blocks Input Tax Credit on passenger vehicles unless they’re used for resale, training, or commercial transport.

Depreciation benefits also sit with the leasing company, not the employer, because the lessor legally owns the car. What the employer does gain is the ability to treat all lease-related payments as business expenses- clean, deductible, and simpler than handling asset depreciation.

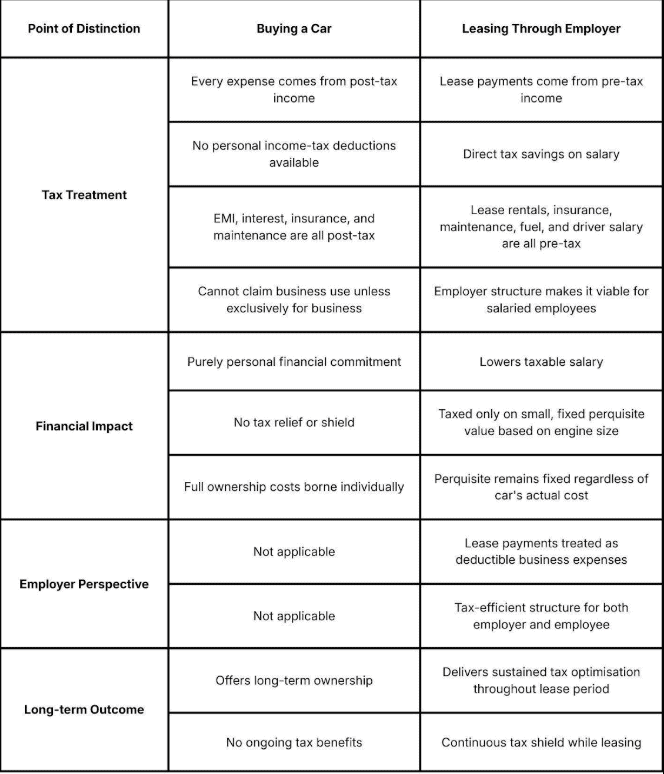

Tax Implications: Leasing vs Buying a Car

For salaried employees in India, the tax implications of buying versus leasing a car through your employer are fundamentally different. Here’s how they compare

Ownership and Depreciation

Under a car lease, depreciation benefits don’t go to the employee; they sit with the leasing company, which legally owns the vehicle. The employee simply uses the car without dealing with asset depreciation or resale value. When buying a car personally, an individual cannot claim depreciation under income-tax rules unless the vehicle is used exclusively for business, a condition most salaried employees don’t meet. This leaves personal ownership without any depreciation-related tax advantage.

Monthly Expense and Cash Flow

Leasing keeps cash flow lighter because there’s no big down payment and no personal loan EMIs. The employee only pays a predictable monthly rental, usually through pre-tax deductions, which softens the impact on take-home salary.

Buying a car demands immediate capital expense, either a hefty down payment or a long EMI cycle funded from post-tax income. Ownership locks up cash and increases monthly pressure, while leasing spreads the cost with far less strain on liquidity.

End of Tenure Options

When the lease period ends, employees are usually given the option to purchase the car by paying its residual value, the predetermined amount the vehicle is expected to be worth after depreciation.

This value is typically far lower than the original on-road price because the leasing company has already claimed depreciation over the years. If the employee chooses to buy it, ownership transfers seamlessly without the hassle of negotiating in the open market. If not, the car can simply be returned or swapped for a new lease, keeping the entire process flexible and hassle-free.

Perquisite Tax on Employer-Provided Car

Perquisite tax on an employer-provided car is calculated using a fixed valuation method under Rule 3 of the Income Tax Rules. Instead of taxing the employee on the real cost of the car or the actual amount spent by the employer, the law uses standardised monthly values based on two factors: the engine capacity of the vehicle and whether the employer bears fuel and driver expenses.

For cars up to 1.6L engine capacity, the taxable perquisite is ₹1,800 per month if the employer covers fuel and maintenance. If a driver is also provided, an additional ₹900 per month is added. For cars above 1.6L, the perquisite rises to ₹2,400 per month plus the same ₹900 if a driver is provided. These amounts remain the same regardless of how expensive the car is or how frequently it is used.

If the employee pays for fuel or maintenance personally, the perquisite value is reduced accordingly. When the car is used entirely for official duties and detailed logs are maintained, the perquisite may be considered nil.

This fixed-value approach makes employer-provided car leases significantly tax-efficient, as employees are taxed only on a small, predictable monthly amount rather than the full cost of the perk.

Tax Treatment for Official Use Only

When a company-provided or leased car is used strictly for official work, the perquisite value becomes nil. To qualify, the employer must maintain proper records such as, travel logs, purpose of each trip, and expense details proving that the vehicle was not used for personal travel. With adequate documentation, the Income Tax Rules allow the entire benefit to be treated as non-taxable. This makes official-use vehicles completely tax-free for employees, with no perquisite added to their taxable income.

Tax Treatment for Personal or Mixed Use

When the car is used partly for personal travel, a fixed perquisite value is added to the employee’s taxable salary. This amount is based on engine capacity and whether fuel or driver costs are covered by the employer. Because mixed or personal use is expected, the tax rules apply a standard monthly value rather than actual expenses, making the perquisite predictable and easy to account for.

Important Compliance and Documentation Requirements

Staying compliant with Income Tax rules is essential when using an employer-provided or leased car, because the tax benefits depend on proper documentation. Employers must maintain clear records that distinguish between official and personal usage. This usually includes a logbook capturing dates, destinations, kilometres travelled, and the purpose of each trip.

Fuel and maintenance bills should be preserved and linked to these logs. If the employer claims that the vehicle is used entirely for official duties, detailed documentation becomes even more critical. Without it, the tax department will treat the car as being used for mixed purposes and impose a perquisite. The employer should also clearly outline the car lease arrangement in the employee’s CTC or benefits policy. Ensuring that the lease agreement, reimbursement claims, and salary deductions are aligned with Rule 3 helps avoid discrepancies.

When documentation is tidy and consistent, the tax benefits remain intact and the compliance risk stays low, keeping the arrangement smooth for both employer and employee.

Maintain Proper Usage Records

Maintain a simple but consistent logbook that records dates, destinations, kilometres travelled, and the purpose of each trip. Pair these entries with fuel bills and maintenance receipts to clearly show which expenses relate to business use. These records protect the employee during assessments and help the employer justify reduced or nil perquisite valuation.

Include Lease Terms in Salary Structure

Make sure the lease terms are clearly built into the salary structure. The lease rental, maintenance allowance, fuel reimbursements, and any driver costs should appear distinctly in the CTC breakup and monthly payslips. When the salary documents mirror the lease agreement, it creates clean visibility during audits and removes ambiguity about how the car benefit is treated for tax purposes.

Who Should Consider a Car Lease for Tax Savings?

A car lease works best for employees who stay with their organisation for a reasonable duration, because the tax benefits compound over multiple years. Middle and senior management professionals often find it especially valuable since their compensation structures allow flexible benefits, and they usually travel for meetings, reviews, or client visits.

Leasing is also well-suited for people living in metro cities, where commuting distances are long and car expenses are high. Those who prefer predictable monthly costs rather than a large upfront payment tend to gain the most, as the structure shields much of the car’s cost from tax. It’s equally useful for anyone who enjoys upgrading cars every few years without dealing with resale hassles. When a steady job role, consistent travel needs, and an employer that offers flexible benefits align, a lease turns into a smart tax-efficient alternative to buying a car outright, blending convenience with clear financial advantages.

Conclusion

Leasing a car through your employer blends convenience with meaningful tax savings, especially when lease rentals, fuel, and maintenance are deducted from pre-tax income. Employees enjoy lower taxable salary and predictable monthly costs, while employers benefit from clean, deductible business expenses.

Still, it’s important to weigh factors like job stability, perquisite tax, and compliance requirements before committing. Since every organisation structures leases differently, checking with HR or a tax advisor helps ensure the plan fits your finances and maximises the advantages available.

Take charge of your financial journey with Jify today. Access expert guidance that can help you optimise your financial strategy for both short-term stability and long-term growth.

Disclaimer: This blog is for informational purposes only and should not be considered as professional tax or legal advice. Please consult a qualified tax advisor for guidance specific to your situation.