The debate of SIP vs FD has taken centre stage in India’s personal finance conversations. Both are popular tools for building savings, yet they function in very different ways. Fixed Deposits (FDs) are known for stability, guaranteed returns, and zero market risk, making them a traditional favourite. Systematic Investment Plans (SIPs), on the other hand, channel money into mutual funds and offer the potential for higher growth by riding market performance.

Deciding which is best, FD or SIP, depends on your financial goals, risk tolerance, and how long you’re willing to stay invested. Each has strengths worth understanding before committing your money.

What Is an SIP (Systematic Investment Plan)?

A Systematic Investment Plan (SIP) is a disciplined way of investing in mutual funds by contributing a fixed amount at regular intervals, monthly, weekly, or quarterly. Instead of investing a large sum at once, an SIP spreads investments over time, allowing you to buy more units when markets are low and fewer when they’re high, a principle called rupee-cost averaging.

SIPs offer flexibility, letting you start with small amounts and increase or pause contributions as needed. As returns get reinvested, the power of compounding gradually builds wealth. Since SIPs are market-linked, they carry some risk but also offer the potential for significantly higherlong-term growth compared to traditional savings instruments.

Key Features of SIP

A Systematic Investment Plan allows investors to contribute small, periodic amounts into mutual funds, making investing accessible and disciplined. Through rupee-cost averaging, SIPs help balance market fluctuations by automatically purchasing more units when prices fall and fewer when they rise. Over time, reinvested returns accelerate growth through the power of compounding, making long-term wealth creation more achievable. SIPs also offer flexibility, you can increase, decrease, or stop investments without penalties, and provide relatively high liquidity, allowing investors to redeem units when needed, depending on the fund type and exit load terms.

Who Should Invest in SIP?

SIPs are ideal for individuals pursuing long-term financial goals such as buying a home, funding education, or building retirement wealth. They suit investors with a moderate risk appetite who are comfortable with short-term market ups and downs in exchange for potentially higher returns over time.

SIPs are also well-suited for salaried professionals or anyone who prefers systematic, disciplined investing rather than lump-sum commitments. They help create wealth gradually while forming consistent saving habits.

What Is an FD (Fixed Deposit)?

A Fixed Deposit (FD) is a traditional investment option offered by banks and financial institutions where you deposit a lump sum of money for a predetermined tenure at a fixed interest rate. Unlike market-linked investments, FDs provide guaranteed returns, meaning the interest rate remains constant throughout the period regardless of market fluctuations.

This makes them one of the safest and most predictable savings instruments available. Investors receive interest either periodically or at maturity, depending on the chosen payout option. FDs are favoured for their capital protection and are ideal for those who want stability rather than growth-driven risk. With flexible tenure options ranging from a few days to several years, FDs are a reliable choice for short- to medium-term financial planning, emergency funds, and conservative investment strategies.

Key Features of FD

Fixed Interest Rate

The interest rate is set at the time of investment and remains unchanged for the entire tenure, providing predictable and guaranteed returns regardless of market fluctuations.

Guaranteed Maturity Amount

Investors are assured of receiving a confirmed principal plus interest amount at the end of the term, offering security and stability.

Flexible Tenure

FDs offer a range of investment periods, from as short as a few days to several years, allowing you to align the deposit with your specific financial goals.

Multiple Interest Payout Options: You can choose how you receive the interest:

- Periodic Payouts (monthly, quarterly, annually) for those needing a regular income stream.

- Cumulative Payout (at maturity) where interest is reinvested for compounding, maximising lump-sum growth.

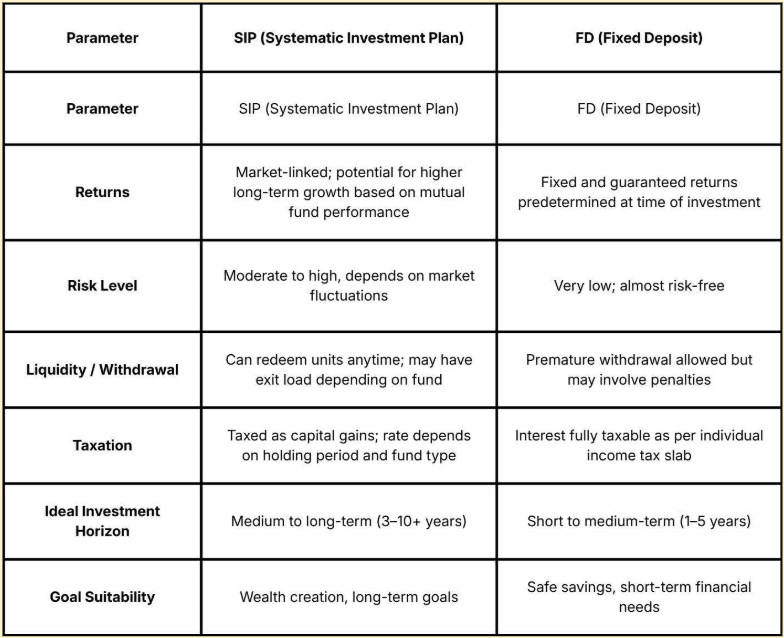

SIP vs FD: Key Differences Explained

The differences between SIP and FD become clear when comparing how each performs across returns, risk, liquidity, and taxation. While FDs offer guaranteed and stable returns, SIPs provide market-linked growth with the potential for higher long-term gains. Risk levels, withdrawal rules, and tax treatment also vary significantly, influencing which option suits different financial needs. Here’s a side-by-side comparison:

Risk and Return Potential

SIPs are tied to market performance, which means their returns can fluctuate in the short term and may involve periods of loss. However, with time and consistent investing, the growth potential is significantly higher, thanks to compounding and market appreciation. This makes SIPs suitable for long-term wealth creation.

In contrast, FDs provide fixed and guaranteed returns, shielding investors from volatility but offering limited growth. While they ensure capital safety and predictable earnings, the returns may struggle to beat inflation over long periods, reducing real wealth expansion.

Liquidity and Lock-in Period

SIPs generally offer higher liquidity, allowing investors to redeem units at any time, although some funds like ELSS carry a lock-in period and certain schemes may charge an exit load for early withdrawals. FDs typically come with a fixed lock-in duration, and breaking them before maturity usually results in penalties or reduced interest rates. While both options permit early access to funds, SIPs tend to be more flexible, whereas FDs prioritise commitment and stability over accessibility.

Taxation on SIP and FD Returns

Tax treatment is a major difference in the FD vs SIP comparison. Interest earned on Fixed Deposits is fully taxable based on your income slab, which can significantly reduce actual returns, especially for individuals in higher tax brackets. In contrast, SIP returns are taxed as capital gains, and the rate depends on how long you stay invested and the type of mutual fund. For equity funds, long-term capital gains (held over one year) are taxed at a lower rate compared to short-term gains, while debt funds follow different rules. This makes SIPs more tax-efficient for long-term investors.

SIP vs FD Investment Example

Let’s compare two popular investment options

Monthly Investment: ₹5,000 for 5 years

Option 1: SIP (Mutual Fund) With an assumed average return of 12% per year, your investment grows through compounding and unit accumulation. After 5 years, your ₹3 lakh investment (₹5,000 x 60 months) could grow to approximately ₹4.08 lakh, giving you a gain of ₹1.08 lakh.

Option 2: Fixed Deposit / Recurring Deposit: The same monthly ₹5,000 at a fixed 7% annual interest would grow to around ₹3.58 lakh, a gain of ₹58,000.

The difference? The SIP potentially gives you ₹50,000 more, though it comes with market risk. The FD offers guaranteed returns and complete safety, but lower growth potential.

Which Is Better: SIP or FD?

Whether SIP or FD is better depends entirely on your financial goals, time horizon, and comfort with risk. If stability, guaranteed returns, and capital protection are your priorities, an FD is a dependable choice. It works well for short-term goals, emergency funds, or situations where you cannot afford any fluctuation in returns, such as planning for upcoming expenses or safeguarding retirement income.

On the other hand, an SIP is designed for long-term wealth creation. It suits investors who can stay invested through market ups and downs and want returns that can outperform inflation. SIPs grow more effectively over time through compounding and market participation, making them ideal for financial goals like a child’s education, a future property purchase, or retirement planning.

Neither product is universally better. Many smart investors use a mix of both FDs for safety and liquidity, SIPs for growth. The right choice depends on balancing risk with reward to match your personal financial journey.

Choose SIP if…

You’re aiming for long-term growth and want your money to work harder than traditional savings options. SIPs are well-suited for goals that stretch over several years, where the power of compounding and market participation can generate inflation-beating returns. They help build substantial wealth gradually while encouraging disciplined investing through regular contributions. If you’re comfortable with moderate market risk and want to grow your capital meaningfully over time, SIPs are a strong choice.

Choose FD If…

You prioritise safety and need a dependable place to park your money without worrying about market ups and downs. FDs are ideal when your focus is capital protection, guaranteed returns, and meeting short-term financial needs. They suit situations where funds may be required soon, like planned expenses, emergency buffers, or retirement income management. For conservative investors who value stability over high growth, an FD provides low-risk assurance and predictable, tension-free savings growth.

Balanced Approach: Combine SIP & FD

A blended strategy using both SIPs and FDs can offer the best of stability and growth. FDs create a secure financial base with guaranteed returns and easy access for short-term needs. SIPs, meanwhile, work steadily in the background to build long-term wealth through compounding and market-linked appreciation. By dividing your investments between the two, you can protect your capital while still pursuing inflation-beating returns. This balanced approach helps manage risk smartly and supports both immediate security and future financial goals.

Factors to Consider Before Investing

1. Financial Goals

- Consider asking if you are saving for something in the near future or building long-term wealth

- Short-term goals may favour FDs, while long-term wealth creation suits SIPs better.

2. Risk Appetite

- Check if you can tolerate market fluctuations. SIPs may be more rewarding but come with ups and downs.

- If you need complete safety and guaranteed returns, FDs offer peace of mind with no market risk.

3. Investment Duration

- SIPs generally perform best over longer periods (5+ years), benefiting from compounding and market growth.

- FDs are useful for shorter horizons (1-3 years) with predictable returns.

4. Liquidity Needs

- Assess how quickly you might need access to your money

- SIPs offer flexible withdrawal options, though equity funds may have exit loads.

- FDs may penalise premature withdrawal, reducing your effective returns.

5. Tax Implications

- FD returns are fully taxable as per your income tax slab.

- SIP taxation depends on holding period and fund type (equity vs debt), often with more favourable long-term capital gains treatment.

Conclusion

SIP and FD are both valuable financial tools, but they serve different purposes. SIPs support long-term wealth creation by harnessing compounding and market growth, making them suitable for future-focused goals. FDs, on the other hand, offer short-term stability with guaranteed returns and minimal risk, ideal when security and predictability matter most.

Rather than asking which is universally better, the real question is which aligns with your priorities and timeframe. As life circumstances and goals evolve, it’s wise to reassess your investments regularly to stay on course.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. The information contained in this article does not constitute investment advice. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.