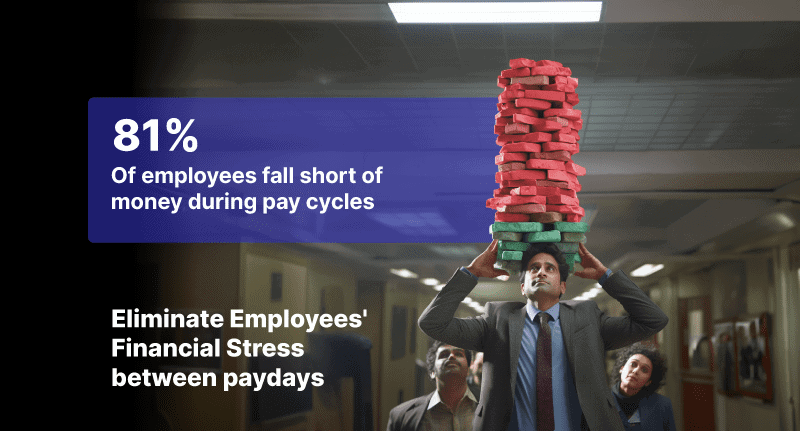

We live in a time where we can forget about waiting in line to buy food or to pay utility bills– in today’s world, instant access is king. Given this, it’s natural to wonder why employees are still stuck waiting weeks for their hard-earned pay. With traditional pay schedules, even basic living expenses can become stressful puzzles. Long pay windows create cash flow gaps, leading to loan shark traps, overdraft fees, and unnecessary burdens.

This is where on-demand salary has found its place to shine. It empowers employees to access their earned wages anytime, giving them control over their finances and eliminating the stress of pay delays. It’s financial freedom built right into their paycheck.

By the end of this article, you’ll fully understand the on-demand salary pros and cons you should consider when implementing EWA.

Pros and cons of On-Demand Salary and its impact on different company sizes

Pros

- On-demand salary serves as a great tool to retain talent, especially for gig workers, as it gives them better financial control and flexibility. In larger companies, it helps with improved brand image and social responsibility.

- In small companies, on-demand salary facilities can alleviate stress, improving attendance and loyalty. In larger companies, it helps employees avoid high-interest loans and manage finances better.

- On-demand salary facilitates financial empowerment to those in smaller companies, as it enables them to be in control of their finances. In large companies, it aids financial health for employees and better decision-making with reduced healthcare costs.

Cons

- Implementation and maintenance costs can be a challenge among small companies, whereas large companies could face compliance and regulatory complexities for implementation.

- Integration with existing payroll systems may require technical expertise, which small companies may not have. On the other hand, In large companies where there are diverse payroll systems, it can be complex and require significant IT resources.

- In small companies, it can lead to budgeting difficulties or irresponsible spending. In large companies; if implemented poorly it can seem predatory and damage employee trust.

The cost factor of On-demand salary for both companies and employees

For both companies and employees, the cost of on-demand salary can vary depending on several factors, including:

For companies:

- Implementation cost

- Legal consultation cost

- Payroll integration cost

- Platform Fees

For employees:

- Interest rate

- Transaction fees

- Monthly fees

Integration with existing HRMS

Integrating On-demand Salary feature with your existing HRMS can depend on a few key factors:

On-demand Salary provider

If the on-demand salary provider has a well-documented API, it can simplify the process of connecting and exchanging data between the EWA platform and the HRMS.

Customizability

A high degree of flexibility allows for tailoring the integration to meet the specific needs of the organisation. On-demand salary providers and HRMS platforms that support configurable integration can make the process smoother.

Technical Expertise

If an organisation’s IT team has handled similar integrations before, they can make things smoother. The likelihood of successful integration is higher in this case.

Testing and Validation

Before fully launching the integration, conduct thorough testing to ensure accurate data exchange and identify any potential glitches.

How can On-demand Salary be integrated with different company sizes and industries?

On-demand Salary’s flexibility shines in its adaptability to various industries and company sizes. Here’s how it integrates across the board:

Industry Regulations:

Different industries may have unique regulatory requirements. Ensure that the solution complies with industry-specific regulations related to finance, payroll, and data privacy.

Evaluate Company Size:

Recognise the scalability needs of different-sized companies. Larger enterprises may require robust, scalable solutions, while smaller businesses may need simpler, more cost-effective integrations.

API Integration:

Leverage well-documented APIs provided by On-demand Salary platforms. API integration facilitates smooth communication between the On-demand Salary system and existing HRMS or payroll systems.

Industry-Specific Customisations:

Tailor the integration to address industry-specific nuances. For example, healthcare organisations might need to align On-demand Salary with healthcare pay cycles, while retail businesses may require features for seasonal fluctuations.

HRMS Compatibility:

Ensure compatibility with various Human Resource Management Systems (HRMS). The integration process should be adaptable to different HRMS platforms commonly used in the industry or by companies of varying sizes.

Data Security Measures:

Industries with stringent privacy standards, such as healthcare or finance, may require additional security protocols to protect sensitive employee information.

Testing and Feedback:

Conduct thorough testing with pilot groups to gather feedback. This helps identify any industry-specific or size-specific issues and allows for adjustments before full implementation.

Vendor partnering:

Collaborate closely with On-demand Salary solution providers to understand industry requirements and tailor the integration accordingly. Solution providers familiar with different industries can offer valuable insights and support.

Other Factors to consider before On-demand Salary integration

Before integrating On-demand Salary solution into a company’s operations, a business owner should carefully consider various factors, namely:

Financial Considerations: Evaluate the costs involved, including platform fees, potential employee misuse, and possible benefits offsets. Analyse potential cost savings from reduced absenteeism and turnover.

Data Security and Compliance: Ensure the On-demand Salary platform complies with relevant data protection regulations and has robust security measures to safeguard sensitive employee information.

Proactive communication: Data Security and Compliance: Ensure the EWA platform complies with relevant data protection regulations and has robust security measures to safeguard sensitive employee information.

Choosing the Right Partner: Find an On-demand Salary Solution provider with a platform that seamlessly integrates with your existing systems and offers features tailored to your needs. Prioritise data security, user-friendliness, and reliable support.

Jify is one of the fastest-growing On-demand Salary partners in India.

Jify understands that employees are the heart of a business. It has transformed payroll services with a cutting-edge on-demand salary solution, designed to reorganise the way businesses operate and employees experience financial well-being.

Imagine a workplace where financial stress is a thing of the past. Jify offers a seamless, user-friendly platform that allows your employees to access their salary on demand, bridging the gap between paydays and life’s unexpected expenses. No more waiting anxiously for the end of the month – our service ensures your employees have the financial flexibility they deserve.

Impact on Cash Flow:

Assess the impact of EWA on the company’s cash flow. Understand how providing access to earned wages in real-time might affect budgeting and financial planning for the business.

Employee Education and Support:

Provide education and support for employees across industries and company sizes. Clear communication about the EWA system, its benefits, and how to use it is essential for successful adoption.

Benefits of Implementing On-demand Salary Structure

Reduces Financial Stress: On-demand salary benefit significantly reduces financial stress and anxiety on employees as it provides a safety net to employees, relieving them of the burden of seeking financial aid from people or other institutions.

Increases Job Satisfaction: When an employee is being cared for and provided for as per their needs, it creates a sense of belonging and boosts their morale, thus leading to job satisfaction. This in turn contributes to creating a positive work environment, which brings about better employee retention in the company.

Attracts talent: Employable workforce are well-informed about companies that go beyond providing statutory benefits. Companies that provide attractive benefits like on-demand salary have better credibility in the market, which enables them to attract top talent.

Increased Performance: Employees who are less worried about their financial situations are generally more focused and productive at work. Reduced financial stress can lead to better concentration and job performance.

Positive Work Environment: Happier and financially secure employees tend to be more engaged and productive, leading to a positive work environment and potential business growth.

Data Insights and Financial Literacy Initiatives: It can offer valuable insights into employee financial needs, allowing companies to design targeted financial literacy programs and resources to further improve employee well-being.

Financial Empowerment and Control: Accessing salary anytime provides employees with increased flexibility and control over their finances, reducing stress and reliance on expensive payday loans or credit cards.

Improved Financial Well-being: It can help employees avoid late fees, overdraft charges, and other financial pitfalls, promoting better budgeting and savings habits.

Conclusion:

Traditional salary payment systems are a relic of the past, they no longer align with the instant-access world we live in. On-demand salary emerges as a beacon of financial freedom, empowering employees and paving the path to a happier, more productive workforce. While challenges like integration and responsible implementation exist, the benefits for both employees and businesses are undeniable.