When you’re ready to drive home a new vehicle, the choice between car leasing vs car loan can impact your monthly budget and long-term financial health. For salaried employees in India, this decision goes beyond just acquiring a car; it affects your take-home pay, tax benefits, and overall financial flexibility.

Whether you’re a young professional eyeing your first sedan or a mid-career employee considering an upgrade, understanding options while making this decision is crucial. This article breaks down the real benefits and drawbacks of both car leasing and car loans. We’ll examine how salary deduction with car leasing works, and compare car loan vs leasing cost structures for employees. By the end, you’ll have a clear framework to decide which financing route best suits your income.

What Is Car Leasing?

Car leasing is essentially renting a vehicle for a fixed period, you pay to use the car without actually owning it. Think of it as a long-term rental agreement with structured terms and conditions.

Here’s how it works: you sign a lease agreement for a specific tenure, typically 2 to 5 years, and make fixed monthly lease payments throughout this period. The lease comes with predetermined usage limits, often capped at 15,000 to 20,000 kilometres per year.

At the end of the lease term, you simply return the car to the leasing company, upgrade to a newer model, or in some cases, purchase the vehicle at a pre-agreed residual value if a buyout option exists.

Example: Instead of paying ₹3 lakh as a down payment plus EMIs on a ₹12 lakh car, you might lease the same vehicle for ₹18,000-₹22,000 per month with minimal upfront costs, including maintenance and insurance in the package.

In India, car leasing has traditionally been more common through corporate tie-ups and company car schemes where employers offer vehicles as part of compensation packages. However, newer retail leasing offerings from banks and specialised leasing companies are gradually making this option accessible to individual salaried employees as well.

How Does Car Leasing Work for Employees?

The car leasing process is designed to be a structured and predictable way to drive a vehicle. Here is the breakdown:

- Vehicle Selection: Choose the specific make and model that fits your needs and budget.

- Lease Agreement: Sign a contract that outlines the terms, conditions, and duration of the lease.

- Fixed Monthly Payments: Pay a set amount each month for the right to use the vehicle.

- Usage Compliance: Follow specific rules during the lease, such as staying within mileage limits and adhering to maintenance schedules.

- End-of-Term Options: Once the tenure is up, you can return the car to the dealer, upgrade to a newer model, or purchase the vehicle at its remaining value.

Most lease packages bundle up the services into your monthly payment, typically including insurance, maintenance, and roadside assistance. Though the exact inclusions vary by provider, so always verify what’s covered.

For employees with corporate car leasing arrangements, monthly payments are often processed through salary deduction, sometimes with tax benefits that reduce your taxable income. Your employer deducts the lease amount directly from your payroll, simplifying the payment process.

An important concept in leasing is residual value. This is the estimated worth of the car at lease end. Higher residual values mean lower monthly payments since you’re essentially paying for the vehicle’s depreciation during your usage period, not its full cost.

The major advantage is- leasing lets you drive a premium, higher-segment car with minimal upfront investment, ideal for employees wanting better vehicles without large capital outlays. The trade-off is that you’re building no ownership equity over time.

What Is a Car Loan?

A car loan is money borrowed from a bank or non-banking financial company (NBFC) to purchase a vehicle, which you then repay through fixed monthly instalments called EMIs (Equated Monthly Instalments). Unlike leasing, you own the car from day one, though the lender holds it as collateral until you’ve fully repaid the loan.

The core components of a car loan include:

- Loan amount: Typically 80-90% of the car’s on-road price

- Interest rate: Usually ranges from 8-12% per annum, depending on your credit score and lender

- Tenure: Commonly 3 to 7 years

- EMI: Your fixed monthly payment covers both principal and interest

A main requirement is the down payment, the upfront amount you pay from your pocket, generally 10-20% of the car’s price. A higher down payment directly reduces your loan amount, resulting in lower EMIs and less interest paid over the loan tenure. For example, paying ₹2 lakh down on a ₹10 lakh car instead of ₹1 lakh saves you thousands in interest and reduces your monthly financial burden greatly.

How Does a Car Loan Work for Salaried Employees?

For salaried employees, a car loan is a milestone purchase that relies heavily on your employment history and steady income. Here is the process broken down:

- Vehicle & Budget Selection: Choose your car and get a ‘Proforma Invoice’ (price quote) from the dealer to determine the exact loan amount needed.

- Lender Application: Apply with your preferred bank or NBFC. Many lenders now offer ‘Pre-approved’ offers to salaried individuals with existing accounts.

- Eligibility Assessment: The lender evaluates your profile based on three key pillars:

- Monthly Income: Usually a minimum of ₹20,000 to ₹25,000 net salary.

- Credit Score: A CIBIL score of 750+ is the gold standard for low interest rates.

- Job Stability: Most banks require at least 1 year with your current employer and 2 years of total work experience.

- Documentation: Submit your KYC (Aadhaar/PAN), last 3-6 months of bank

statements, and salary slips. You will also need Form 16 or ITR as tax proof. - Approval & Sanction: If eligible, the bank issues a sanction letter. You then pay the down payment (the portion not covered by the loan) to the dealer.

- Disbursement: The bank pays the loan amount directly to the car dealership.

- Repayment (EMIs): Monthly payments begin automatically via ECS (Electronic Clearing Service) from your salary account.

Most lenders offer tenures ranging from 3 to 7 years. While longer tenures mean lower monthly EMIs that feel easier on your budget, you’ll pay significantly more in total interest over time. For example, a ₹5 lakh loan at 10% interest costs ₹3.87 lakh in total interest over 7 years versus ₹1.32 lakh over 3 years.

Banks carefully evaluate your debt-to-income ratio, and what percentage of your monthly salary goes toward existing EMIs (home loan, personal loans, credit cards). Lenders typically prefer this ratio to stay below 40-50% to ensure you can comfortably manage payments.

Important to remember: Unlike leasing, all ongoing costs are your responsibility. You’ll need to budget separately for insurance renewals, regular servicing, unexpected repairs, and maintenance.

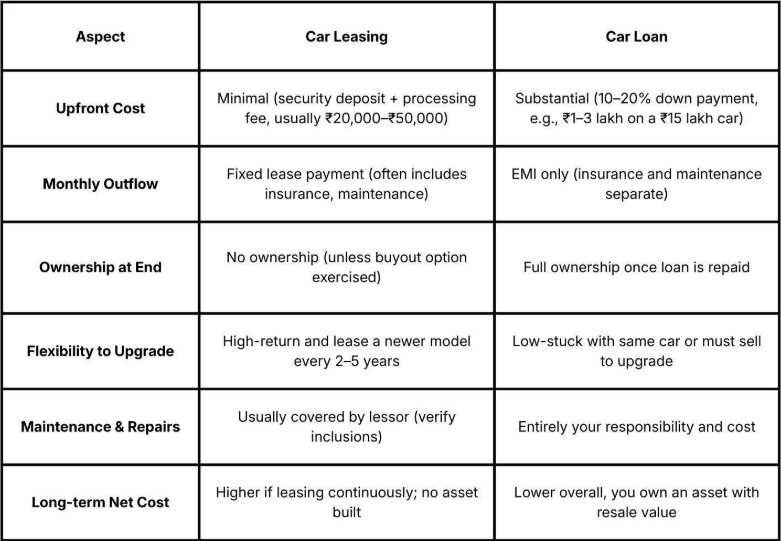

Car Leasing vs Car Loan: Key Differences You Should Know

Additional considerations: Regardless of your choice, you’ll still bear costs like fuel, parking charges, and toll fees. With loans, you’ll also handle insurance renewals (₹15,000-₹40,000 annually) and servicing costs (₹5,000-₹20,000 per service) separately, while many lease agreements bundle these into your monthly payment, offering predictable budgeting but potentially at a premium.

When Does Car Leasing Make More Sense?

Car leasing makes more sense when you’d rather have flexibility and pay less money at the start, even if it means you won’t own the car in the end.

1. You prefer driving the latest models

If you’re someone who wants to upgrade to newer cars every 3–4 years with the latest features and technology, leasing lets you do this seamlessly without the hassle of selling your old vehicle.

2. Limited capital for down payment

When you can’t or don’t want to block ₹2–3 lakh upfront, leasing requires minimal initial investment, freeing your savings for other priorities like investments or emergency funds.

3. Corporate leasing benefits available

If your employer offers salary deduction car leasing as part of your compensation package, you may enjoy tax advantages where lease payments reduce your taxable income, effectively lowering your tax burden.

4. Predictable budgeting matters most

Leasing provides fixed monthly costs with insurance and maintenance typically bundled in, excluding repair bills. It’s ideal for employees who value financial predictability over asset accumulation.

5. Short-term job postings

For professionals on 2–3 year assignments in specific cities, leasing avoids the complications of buying and later selling a car.

When Does a Car Loan Make More Sense?

A car loan emerges as the better option when long-term ownership and unrestricted usage align with your lifestyle and financial planning:

1. Long-term vehicle retention

If you plan to keep your car for 7–10+ years or longer, buying builds an asset. Once the loan is repaid, you enjoy years of payment-free driving, making the total cost of ownership significantly lower than continuous leasing.

2. Comfortable with upfront investment

When you have savings for a down payment and can manage slightly higher initial EMIs, ownership means you’re building equity in an asset rather than paying indefinitely for usage rights.

3. High mileage requirements

If you drive extensively, travelling long distances daily or frequent intercity travel, you’ll quickly exceed the lease limits of 15,000-20,000 km annually. Loans impose no mileage restrictions, giving you unlimited usage freedom.

4. Desire for complete control

Ownership grants you freedom to modify, customise, or upgrade your vehicle as you wish. You can also pass it to family members or keep it as a reliable second car without worrying about lease terms or return conditions.

A Simple Checklist to Decide: Lease or Loan?

Use this practical checklist to evaluate which option, i.e. car leasing vs car loan, fits your financial situation and lifestyle:

1. Monthly budget capacity

How much can you comfortably allocate for total car expenses monthly, including lease/EMI payments, fuel, parking, and insurance? Leasing offers predictable costs, while loans require budgeting for variable maintenance expenses.

2. Vehicle retention timeline

Do you typically keep cars for 3-4 years before wanting an upgrade, or do you prefer driving the same vehicle for 7-10+ years? Short-term users benefit from leasing; long-term owners save significantly with loans.

3. Emergency fund readiness

Do you have ₹50,000-₹1 lakh set aside for unexpected repairs and maintenance if you own? Leasing eliminates this concern with bundled service packages.

4. Corporate leasing availability

Does your employer offer salary deduction car leasing with tax benefits that improve the financial equation? Corporate schemes often provide cost advantages over retail options.

5. Ownership importance

How much does owning an asset matter to you versus simply having reliable transportation? If building equity matters, a loan is a good option; if flexibility matters more, consider leasing.

6. Annual driving distance

Will you exceed 20,000 km yearly? High-mileage drivers face penalties with leasing but no restrictions with ownership.

7. Down payment availability

Can you comfortably pay 10-20% upfront without depleting savings meant for emergencies or investments?

Jify Perspective: Keeping Your Car Decision EMI-Safe for Your Future Self

At Jify, we believe major financial decisions like choosing between car leasing vs car loan shouldn’t push you back into a paycheck-to-paycheck cycle. A car should enhance your life, not become a financial burden that derails your long-term investment goals.

Before you sign that lease agreement or loan document, take these three critical steps:

1. Calculate your total EMI load

Add up all existing EMIs (home loan, personal loans, credit cards) plus the proposed car payment. Ensure this doesn’t exceed 40-50% of your monthly take-home pay, leaving breathing room for savings and unexpected expenses.

2. Build your safety net first

Have at least 3-6 months of essential expenses saved as an emergency fund before committing to a car payment. This cushion protects you if income disruptions occur or major repairs arise (especially relevant for car loan holders).

3. Project your financial future

Map how the new monthly outflow affects your savings goals over the next 12-24 months. Will you still contribute to retirement funds, investment SIPs, or that home down payment you’re building?

A car is meant to drive you forward financially and literally. Make the choice that keeps both journeys smooth.

Final thoughts: So, what makes more sense for you?

The car leasing vs car loan decision doesn’t have a one-size-fits-all answer. It depends entirely on your financial situation, lifestyle preferences, and long-term goals.

If you value flexibility, like driving newer models, and you have predictable monthly costs, car leasing could be your ideal match. On the other hand, if you’re looking to build an asset, plan to keep your vehicle for many years, a car loan makes more financial sense.

Whichever path you choose, don’t compromise your financial stability or future aspirations. Your car should be a tool for progress, not a trap that limits your financial freedom.

Ready to make smarter financial decisions? Explore Jify’s resources and tools designed to help salaried employees like you plan EMIs wisely, build emergency funds, and protect your future self from financial stress.

Whether you’re leasing or buying, let’s make sure your car choice drives you toward financial confidence, not away from it.

*Disclaimer:

The information contained herein is not intended to be a source of advice concerning the material presented, and the information contained in this article does not constitute financial advice. The ideas presented in the article should not be used without first assessing your financial situation or without consulting a financial professional.