When it comes to managing your money, finding the right balance between short-term financial goals and long-term financial goals is key to building real wealth. Short-term investments provide accessible funds for immediate needs, while long-term investments build future security and growth. Over focusing on one can lead to present cash shortages or future unpreparedness. Understanding this dynamic allows for smarter choices that support both current living and future ambitions. Wise investment, not just any investment, is key.

Understanding Short-Term vs. Long-Term Investments

Short-Term Investments

Short-term investments are primarily focused on safety and liquidity. They come with low risk and allow quick access to your funds when needed, making them perfect for immediate or near-future needs. If you’re working toward short-term financial goals like an emergency fund, travel, or minor home repairs, these options are your go-to.

Common examples include savings accounts, fixed deposits (FDs), and debt mutual funds. While they offer lower returns compared to long-term assets, the security and flexibility they provide are crucial for financial stability.

Long-Term Investments

Long-term investments are built for those aiming to create significant wealth over several years or decades. They carry higher volatility, meaning the value may fluctuate in the short run, but they generally yield better returns over time.

These investments align with major long term financial goals like retirement planning, purchasing property, or funding higher education. Examples include stocks, equity mutual funds, and retirement plans. Staying invested over the long term allows you to ride out market ups and downs and benefit from compounding growth.

Assessing Your Financial Goals

Short-Term Goals

Short-term financial goals are those you aim to achieve within a few months to a few years. These are immediate priorities that require accessible and secure savings. Building an emergency fund, planning for a home renovation, or setting aside money for upcoming travel plans are all examples of short-term goals. Since the time frame is shorter, it’s important to choose low-risk, high-liquidity investment options to ensure that your money is both safe and easily available when you need it.

Long-Term Goals

Long-term financial goals usually stretch over several years or even decades. These goals require disciplined planning and a willingness to weather market fluctuations for greater returns.

Retirement savings, funding your child’s education, or purchasing a dream home are classic examples of long-term goals. For these objectives, you can afford to take on higher risk through investments like stocks, mutual funds, or retirement plans, with the expectation that your wealth will grow steadily over time.

Strategies for Balancing Investments

Diversify by Investment Duration

One of the smartest and most effective ways to manage your investment portfolio is by diversifying based on investment duration. This means allocating your funds across short-term, medium-term, and long-term instruments, depending on your financial goals and time horizon.

Short-term investments offer quick access to funds, making them ideal for emergencies or planned expenses in the near future. On the other hand, long-term allow your money to grow steadily over time and benefit from compounding. Spreading your investments across different durations, allows you not only maintain liquidity for immediate needs but also create a solid foundation for future wealth creation.

Use the 80/20 or 60/40 Rule

Simple allocation rules like 80/20 or 60/40 can guide your investment strategy. If you’re younger or have a higher risk appetite, you might lean towards 80% long-term investments and 20% short-term. This rule states that, for many events, roughly 80% of the effects come from 20% of the causes. If you’re closer to major financial goals or prefer lower risk, a 60/40 split may suit you better. Adjust based on your age, risk tolerance, and financial needs.

80% – Long Term Investment Options: These are growth-focused and suited for goals 5–10+ years away (like retirement, buying property, or funding your child’s education):

- Stocks (Equities): Directly buying shares of companies through stock exchanges

- Mutual Funds / Index Funds: These are managed by professionals. You can invest in large-cap, mid-cap, or sectoral funds. Index funds are low-cost and follow indices like Nifty 50.

- Exchange-Traded Funds (ETFs): These are traded like stocks but represent a basket of securities. They are good for diversification at lower costs.

- Public Provident Fund (PPF): They have a Long lock-in, have tax benefits, and give steady interest rates.

- National Pension System (NPS): They are mainly for retirement planning with partial equity exposure.

- Real Estate: Buying property or investing through REITs (Real estate investment trusts).

20% – Short-Term / Liquid Investment Options: These options are for emergencies, short-term goals (1–3 years), or quick access:

- High-Yield Savings Account: This keeps your money safe, easily accessible, and earns better interest than regular savings.

- Fixed Deposits (FDs) / Recurring Deposits (RDs): They give guaranteed returns, low risk. Ideal for short-term certainty.

- Liquid Mutual Funds: This offers better returns than savings accounts, with quick redemption (1–2 days).

- Gold (Digital or Physical): It’s not highly liquid, but can be partially part of short-term assets.

Let’s look at an example:

Varsh is 30 years old with a stable income and a long-term goal of retiring at 60. Since he has a high risk tolerance and a long investment road, he chooses the 80/20 rule:

80% of his money goes into long-term investments like stocks, equity mutual funds, or index funds. 20% goes into short-term instruments like fixed deposits, liquid funds, or a high-yield savings account for emergencies or near-term needs.

Meanwhile, Ankita is 55 years old and planning to retire in the next 5–10 years. She’s more focused on preserving her capital than aggressively growing it. She opts for the 60/40 rule:

60% of her portfolio goes into relatively stable, long-term investments like balanced mutual funds or bonds. 40% is kept in shorter-term, lower-risk assets to ensure liquidity and security as she nears retirement.

Open Goal-Based Investment Accounts

Every individual has a range of financial goals, some short-term, others long-term. The process of regularly investing with the purpose of meeting these specific goals is what goal-based investing is all about.

Step 1: Identify Your Goals – Begin by listing out all your financial goals based on timelines:

- Short-term goals (within 1–3 years): Buying a car, vacation, or emergency fund

- Medium-term goals (3–7 years): Saving for a home down payment or a business

- Long-term goals (7+ years): Retirement, child’s higher education

Step 2: Determine the Time Horizon – Once you’ve identified your goals, calculate how many years you have to achieve each one.

Step 3: Calculate the Future Cost – Estimate the current cost of the goal, then adjust for inflation to find out how much you’ll actually need in the future.

Example:

- Goal: Child’s education

- Time horizon: 10 years

- Current cost: ₹20,00,000

- Estimated inflation rate: 6% annually

- Future cost: ₹20,00,000 × (1.06)^10 = ₹35,76,000

You need to plan investments that will grow to ₹35.76 lakhs in 10 years; not just the current ₹20 lakhs.

Managing Risk Across Time Horizons

Your investment time horizon and risk tolerance are closely linked. Generally, the longer your time horizon, the greater the level of risk you can take on, since you have more time to recover from market fluctuations or underperformance. This flexibility allows you to pursue higher-growth investments without harming your overall financial goal.

Here are a few ways to manage your risk and investment period:

Know your Risk Tolerance

Understanding your risk tolerance is crucial to building a portfolio that matches your financial goals and emotional resilience. Risk tolerance is influenced by factors like age, income stability, investment goals, and psychological comfort with losses.

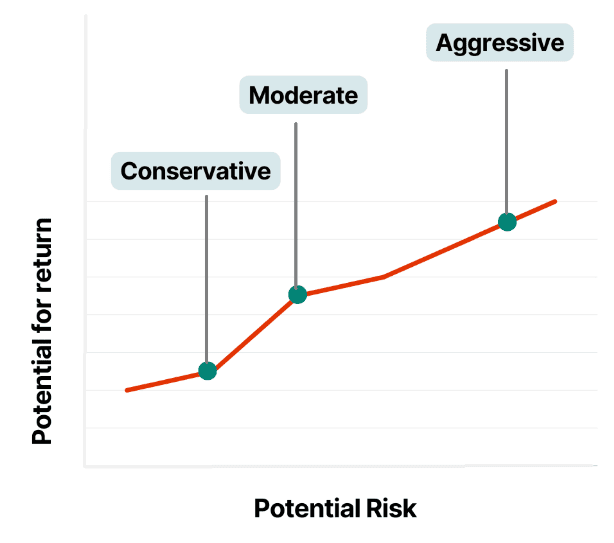

Here’s how it typically breaks down:

- Aggressive/High Risk Tolerance:

Suitable for younger investors or those with long-term goals (15+ years), like retirement. For example, historical data from the S&P 500 shows an average annual return of 10% over the past 90 years, despite periods of heavy volatility like the 2008 crash or the COVID-19 dip. These investors can withstand short-term losses to capitalise on long-term gains.

Typical Allocation: 80–90% equities, 10–20% bonds. - Moderate Risk Tolerance:

Ideal for investors seeking a balance between growth and stability. These investors might be 5–10 years from a major financial goal (such as buying a house, college education for children).

Typical Allocation: 60% equities, 40% bonds or hybrid funds. - Conservative/Low Risk Tolerance:

This is preferred by those with short timeframes (1–3 years) or limited ability to absorb losses. Think retirees or individuals saving for a near-term down payment. For them, capital preservation outweighs high returns.

Typical Allocation: 20–30% equities, 70–80% fixed-income or cash equivalents.

The potential for higher returns comes with a higher level of risk

Data reference: Source

2) Watch for Market Volatility

Market volatility happens when the prices of securities increase or decrease within a short period. It’s commonly measured using the Volatility Index (VIX), also known as the fear gauge. A higher VIX suggests greater uncertainty or fear in the market. For example, during the COVID-19 pandemic in March 2020, the VIX spiked to above 80, indicating extreme market turbulence.

For short-term goals (like travel, emergency funds, or down payments), high volatility poses a greater risk, as you may need to withdraw funds during a market dip. Safer instruments like liquid funds, short-term debt funds, or fixed deposits are better suited for such goals due to their stability and predictable returns. Emotional discipline is important to avoid reactive decisions during market fluctuations.

Long-term investments, like retirement or education planning, can withstand short-term volatility. Historically, equity markets have rebounded over time. For instance, despite the sharp fall in 2008, the Nifty 50 recovered all its losses within three years, rewarding patient investors. Long-term investments benefit from rupee cost averaging via SIPs, where you buy more units when prices are low, improving your overall return.

In fact, investment periods of 15 years or more have consistently delivered returns exceeding 7%, reinforcing the value of staying invested through market cycles.

Conclusion

Finding the right balance between short-term and long-term investments isn’t just financial strategy, it’s the foundation of lasting financial wellness. By thoughtfully allocating your assets across different time horizons, you create a foundation that supports both immediate needs and future dreams.

Remembering these key principles can help you build a balanced portfolio.

If you are keen on taking control of your financial future with a balanced investment approach, visit Jify today. Access expert guidance that can help you optimise your investment strategy for both short-term stability and long-term growth.

Disclaimer: This article is solely for educational purposes. The securities/investments quoted here are not recommendatory.