Enable On-Demand Salaries.

Be the Company In Demand.

Enable On-Demand Salaries. Be the Company In Demand.

Earned pay advance

Zero-cost integration

Interest-free

Over 70% of the Indian workforce lives paycheck to paycheck

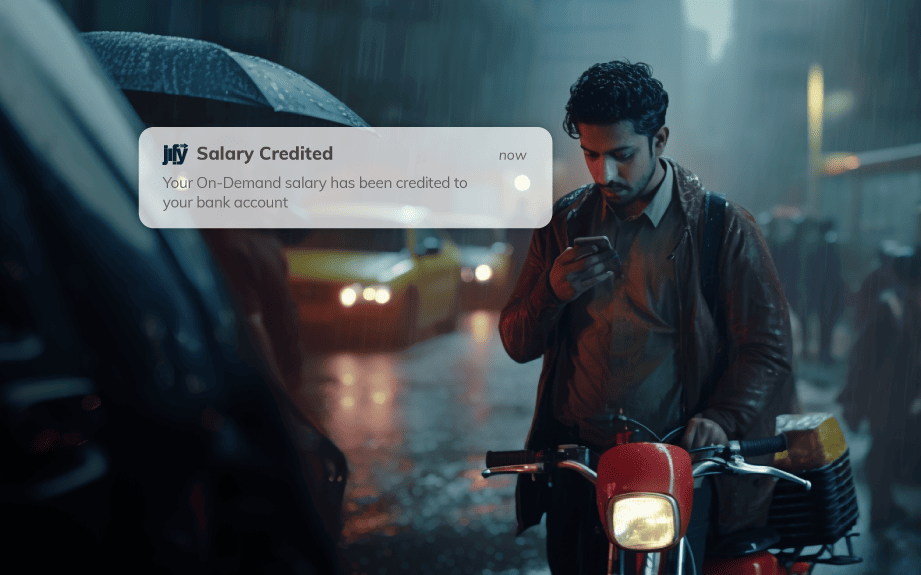

Meet Raj, a hardworking employee…

Although Raj is dedicated towards his job, his productivity has been impacted lately due to financial difficulties. Having asked his employer and colleagues for help once, he feels hesitant to do so again and is now demotivated at work due to his financial issues.

But what if there was a simple and zero-investment solution that could safeguard Raj’s financial wellness and increase her productivity at work, all while removing the stigma of “having to ask”?

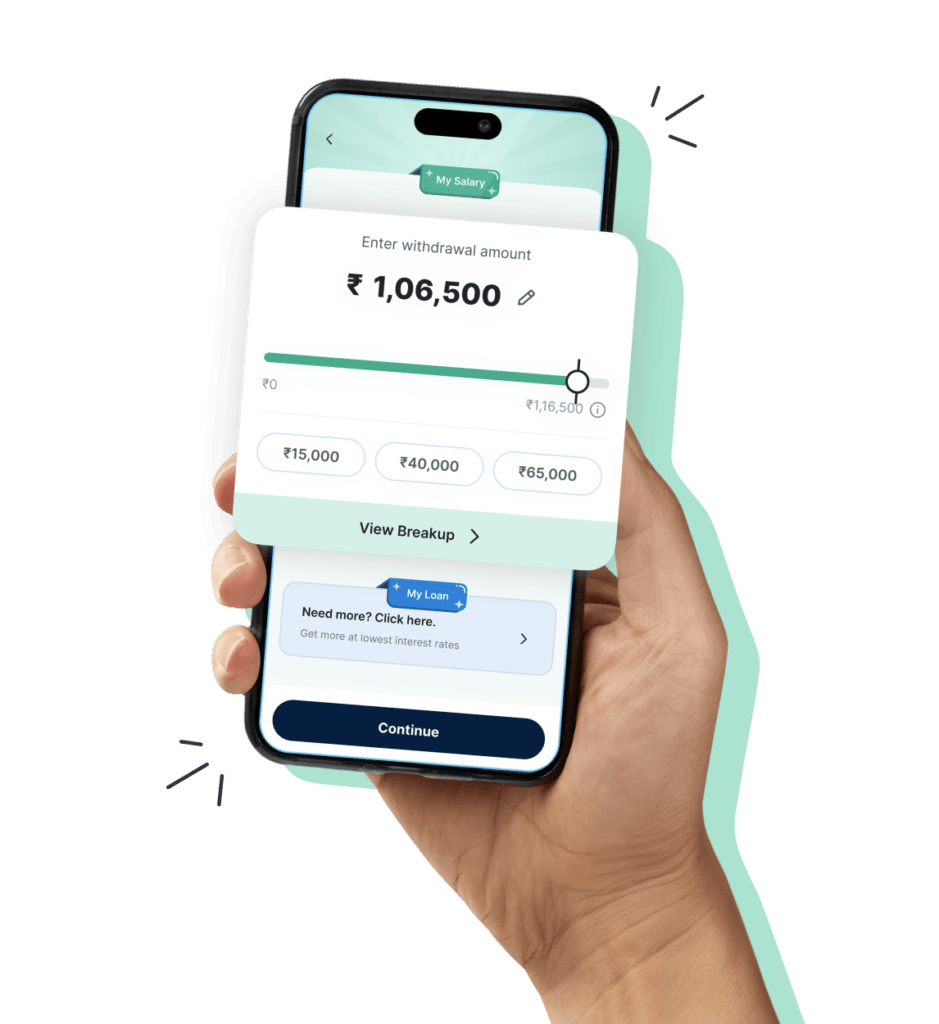

Introducing Jify’s FINANCIAL WELLNESS PLATFORM, where employees can

Access their earned salary anytime, anywhere

Make repayments at their own pace with flexi-repayment

Keep a real-time countdown to the next payday for smart financial planning

Spend smarter with the Jify Salary and Benefits Card

Save better with micro-savings tools and personalised rewards

Here's how it helps employers to invest in their employees' financial wellness:

Meet your employees’ financial needs in a Jify

Get started in just four easy steps

Our Investors

Security & support you can trust

Data security

Tested and secured by top agency - Appknox Keeping your information well-protected, always

Information security

ISO 27001- Certified for the highest data securityFor your data is priceless

Anytime assistance

If you need help, Jify’s support team is standing by 24/7Reach our team by phone or email for a friendly, smooth and quick resolution

Let’s partner up

Schedule a demo to see how you can empower your employees to take control of their finances towards a brighter financial future!

Join our rapidly growing community that is relentlessly working towards making a difference!

Have questions?

Get answers in a Jify!

About Jify

At Jify, we enable you to empower your employees with their money, when they need it. With us, you partner with the ultimate tool for improving employee financial wellness, in turn improving your engagement and retention rates.

How does Jify work? How soon can Jify go live with an employer / corporate?

Jify integrates seamlessly with attendance and payroll systems or provides offline go-live modality. Once onboarded, Jify provides real-time on-demand salary access to employees, with additional financial wellness tools (as decided by the employer/ corporate).

We do not impact the employer’s working capital. Jify’s financing partners advance the money to the employees directly and hence, there is no risk exposure to the employer.

How soon can Jify go live with an employer / corporate?

It takes anywhere between 3-5 days, but can vary for some corporates. Jify provides a dedicated team for every employer to ensure a seamless experience.

Is this going to add additional workload to finance/payroll?

Simply put – no.

Our proprietary system integrates seamlessly with your payroll software allowing you to continue operating as if nothing had changed.

How is Jify different from the other lenders in the market?

We offer full flexibility to employees to manage their finances while offering educational and learning tools to promote best practices.

No more predatory loans, lengthy KYC processes and loan refusals.

Are there costs to the company for offering Jify?

None at all.

Partnering with Jify is completely free for the corporates and absolutely risk-free!